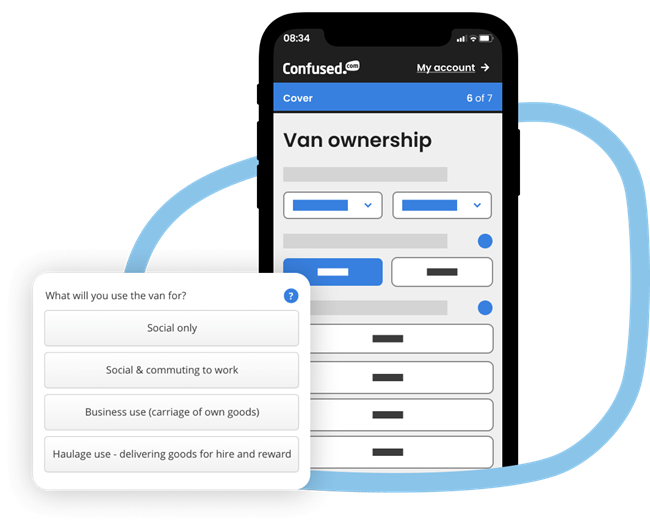

What you use your van for should dictate what type of insurance you'll need to buy. To compare van insurance quotes, you need to tell us the class of use according to how you use your van. There are 4 options:

Social only

Also known as private van insurance, this is suitable for visiting family and friends, shopping or transporting kit for a hobby. It does not cover work or business related travel such as commuting. Pick-ups are classed as vans rather than cars when it comes to insurance. So to make sure your pick-up truck is covered, you need a van insurance policy.

Social and commuting

This would be necessary if you use your van to drive to a single place for work, as well as for social use. If you're travelling to a bus or train station as part of your commute, this also comes under social and commuting.

Business use

This would cover you to transport goods, tools, or work equipment that belongs to you, your business partner, or your employer. It's also known as commercial use or carriage of own goods. This cover is particularly suited to professionals like builders, shopkeepers and cleaners who rely on their van for their business. Business use is also available as temporary cover for short term use.

Haulage use

This is for situations where you use your van to transport goods for hire and reward. This type of cover is especially important for professionals who handle deliveries, such as delivery drivers, couriers, and haulage contractors.