"Making a list of everything you might want cover for can be useful, including any medical conditions, activities and gadgets. This way, you can compare the details of the policies we show you to make sure you're getting the right cover for your group."

How does group travel insurance work?

Group travel insurance covers multiple people on one policy. It covers things like lost baggage or medical costs while you're away.

If you're going on holiday with a group of up to 10 people, a group travel insurance policy can save you the admin of buying individual policies. It can sometimes work out cheaper, too!

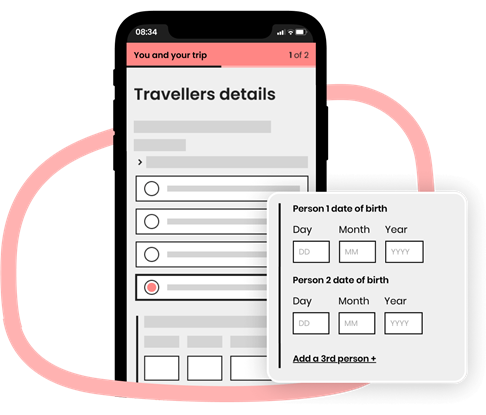

When you get a quote with us, we'll ask you for some information on your trip and the type of cover you need. We'll then ask who you want to be covered on the policy. You can select 'group' - all we need to know is the date of birth for each person you want to include and whether anyone included on the policy has any pre-existing medical conditions.

How to compare group travel insurance quotes

Tell us about yourself

Who needs to be covered

We'll do the hard work

1Correct as of February 2025

Additional cover for your holiday

You have a few options for additional cover on group travel insurance. These extras come at an additional cost, so it's worth checking what's included on a standard policy before you buy.

Let's take a look at what you could choose:

Things to consider before getting travel insurance for a group

-

Level of cover

Think about how much cover you want for your group. For example, your policy might only provide £1,000 worth of cancellation cover. This might not be enough to cover 10 people. If you're travelling with a large group, make sure you've got the right level of cover in place.

-

Pre-existing medical conditions

If you, or anyone in your group, has a pre-existing medical condition, this might increase the overall cost of your policy. In some cases, it might be cheaper to take out individual policies.

-

Travel arrangements

If you decide to buy group travel insurance, your policy might state that you need to travel to your destination together on the same mode of transport. Otherwise you might not be covered.

-

Children

If you're travelling with a group and you want to bring your kids along, you can. Some travel insurers let you add children to your policy for no extra cost. Or, if it's just you and your children travelling, a family travel insurance policy may work out better for you.

-

Policy excesses

Generally, each person named on a group travel insurance policy has an excess. This is the amount you pay towards any successful claims, and is usually taken from your final payout. Typically, having a higher excess means your policy costs less. But, it's important to set your excess at an amount you could afford.

Have you got the right level of cover for your group?

Why use Confused.com?

-

We compare quotes from leading UK travel insurers

We'll compare your information against the panel of insurers that we work with to find you our best quotes.

-

We're rated highly by our customers

We helped more than 250,000 customers get travel insurance last year, so they're able to relax and enjoy their holiday.

-

Compare policies quickly and easily

We make it quick and easy to compare travel insurance quotes. Saving you time and hassle!

-

We're regulated by the Financial Conduct Authority (FCA)

And so are all of the travel insurance companies we work with. This means we follow strict guidelines to ensure you're treated fairly.

Frequently asked questions

Does everyone who's part of the group need to live together?

No, you don’t need to live together to get group travel insurance. You don’t need to be related either. You can get a policy for up to 10 people, but anyone can be in this group and be covered by a group travel insurance policy. Be sure to check the policy documents carefully before you buy to make sure you've got the right level of cover for your group.

Can you travel separately on annual group travel insurance?

This will depend on your provider - some allow solo travel, but others will stipulate that everyone named on the policy must travel together. If you're unsure, it's always worth contacting your insurer to check.

Related travel insurance guides

You might also be interested in

Our service is free and compares a wide range of trusted household names. Confused.com is an intermediary and receives commission from theidol.com if you decide to buy through our website which is based on a percentage of the total annual premium. We pride ourselves on impartiality and independence – therefore we don't promote any one insurance provider over another.