"Business van insurance will cover your van for work-related driving, but it won’t normally cover the other things you may want insured. Tool insurance, public liability cover and goods in transit insurance are all useful extras you can add on to your policy, and they’re often worth the extra expense. Select the extras you want when you get a quote and we’ll do the rest to find you the policy you need at the right price."

What type of business van insurance do I need?

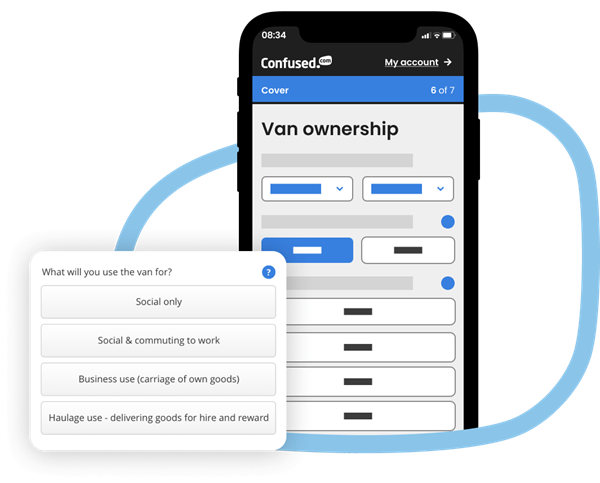

At Confused.com, we compare quotes for two types of business van insurance. We refer to these as classes of use.

We’ll ask you which class of use you need when you get a quote. Pick the one that most closely fits the type of driving you do.

-

Carriage of own goods is for those who drive a van as part of their job but do not carry other people’s goods while doing so. This includes self-employed tradesmen, gardeners and mobile hairdressers who may carry their own equipment with them while driving from job to job, but do not carry parcels, or other items belonging to clients.

-

Hire and reward insurance is for couriers, delivery drivers and long-distance hauliers who carry other people’s goods as part of their job. It’s sometimes known as courier insurance, and covers the vehicle you’re driving while you make deliveries. It doesn’t cover the goods you’re carrying though. For this you’ll need goods in transit insurance.

How much is business van insurance?

Average cost of business van insurance2.

Hire and reward insurance

£2,011.58

Carriage of own goods insurance

£751.78

2Based on Confused.com data November 2023 to April 2024.

Your van insurance price is based on a range of factors including:

The value of your van, as bigger, pricier vans cost more to repair and replace, and are pricier to insure as a result.

Your driving history, as drivers with points or convictions are seen as riskier by insurers, who charge them more for their cover.

The type of driving you do, as couriers who spend a lot of time on the road carrying valuable items are seen as riskier to insure.

The areas you drive in, as those working in areas with higher than average crime levels may be at greater risk of vehicle theft.

How can I get cheaper cover?

What you pay for your insurance is largely based on risk. Insurers give each driver a 'risk profile', which is determined by things like your driving history and your van's insurance group.

Anything you can do to bring your risk profile down could help you save. With business van insurance, this includes things like:

Adding signage to your van which can make it easier to trace if it’s stolen and can help deter thieves.

Installing internal racking in your van, which can lower the risk of loose items causing an accident. Our data shows that this could bring your costs down by an average of 17%(2) on a carriage of own goods insurance.

Joining a trade federation, which can be an easy way to save as some insurers offer discounts for members. Our data shows that members of bodies like the Gas Safe Register paid £54(2) less on average for their cover.

Improving your van's security is one of the most obvious ways to lower your risk profile, with our data showing that even simple factory installed immobilisers can cut the average cost of cover by as much as £74(2).

Considering black box van insurance as these policies are often cheaper than standard van insurance, and come with fewer restrictions than you might think.

Choosing comprehensive cover can be a quick way to save, as fully comp policies tend to be far cheaper than other levels of insurance despite giving you a higher level of cover.

Avoiding auto-renewal as comparing quotes is one of the quickest ways to save. Get a quote in minutes to see our best deals, and find the right cover for you at the right price.

Explore more van insurance saving tips

(2)Confused.com data November 2023 to April 2024.

What other types of cover might I need?

If you’re driving for business purposes, you may need to have certain types of business insurance in place alongside your commercial van insurance. Some policies include this as standard, but others may only offer it as a paid-for add-on.

Popular types of business insurance drivers choose include:

Public liability insurance

Employers’ liability insurance

What extras can I add to business van insurance?

Some insurers offer extras that you can add on to your policy for an additional fee. These can help ensure your cover does exactly what you need it to.

Useful add-ons for commercial van drivers include:

- Breakdown cover

- Courtesy van cover

- Legal expenses cover

- Windscreen and window cover

- Cover for European driving

- Sat nav and audio cover

Breakdown cover can help get you driving again so you don't miss a day's work.

Courtesy van cover provides you with a temporary replacement vehicle while yours is being fixed, helping to keep you on the road.

Legal expenses cover can help you cover the cost of going to court if you're involved in an accident.

Windscreen and window cover can help you cover the cost of repairing your windows if they're chipped of smashed.

Cover for European driving is useful if you drive abroad as part of your business. Some policies include this for free but others may charge to add it on..

Sat nav and audio cover insuresany audio equipment and sat navs in your van.

Our customers say:

Need more help?

Can I insure multiple vans on a single policy?

Yes, if you have multiple vans that you use for business purposes, you can insure them all under a type of business van policy known as fleet insurance. Our standard commercial van insurance policy won’t cover more than one van.

Fleet insurance can cover anything from 2 vans up to a few thousand, and cuts down on the time and admin it takes to insure multiple vehicles. You’ll have one easy-to-manage policy that allows you to keep track of exactly what you’re covered for, for how long and for how much.

It’s also usually cheaper than insuring several vans under separate policies.

Can I add additional drivers to a commercial van insurance policy?

Yes. Just like with standard van insurance, you can add additional drivers to a commercial policy. Just be aware that it might affect what you pay - especially if they’re an inexperienced driver.

Looking to add more than one driver to a single policy? Then any driver van insurance might be worth looking at. This lets you insure a vehicle, or vehicles, for use by multiple drivers - which can be handy if you have several workers using the same van, for instance.

Fleet insurance is also handy and can be useful if you want to cut down on the admin of insuring several drivers and vehicles at once.

To add someone to a van insurance policy, you’ll need their details when you get a quote. This includes things like their licence type, how long they’ve held it and whether they’ve had any previous accidents or driving convictions.

How old do I need to be to get commercial van insurance?

You need to be 21 or older to buy commercial van insurance.

Can I get my business van insured under my company name?

Yes. If your van is registered to or owned by your company, some insurers will allow you to buy a policy under your company's name.

This isn’t always the case, though and some insurers will insist that the main driver is also the policyholder. This means the van would need to be insured under the driver’s name, rather than the company name.

Does commercial van insurance cover driving in Europe?

You may be covered for driving in Europe, but this doesn't always come as standard. Check your policy or contact your insurer to find out.