"Whether you're seeking the adrenaline rush of skiing or the enchantment of a sleigh ride through a snowy forest, it's crucial to consider the risks involved. For all snow-related sports and activities, having the right insurance cover is essential if you want to ensure you're protected. This is where winter sports insurance comes in. With the right policy in place, you can focus on enjoying your winter adventure to the fullest."

How to compare winter sports insurance quotes

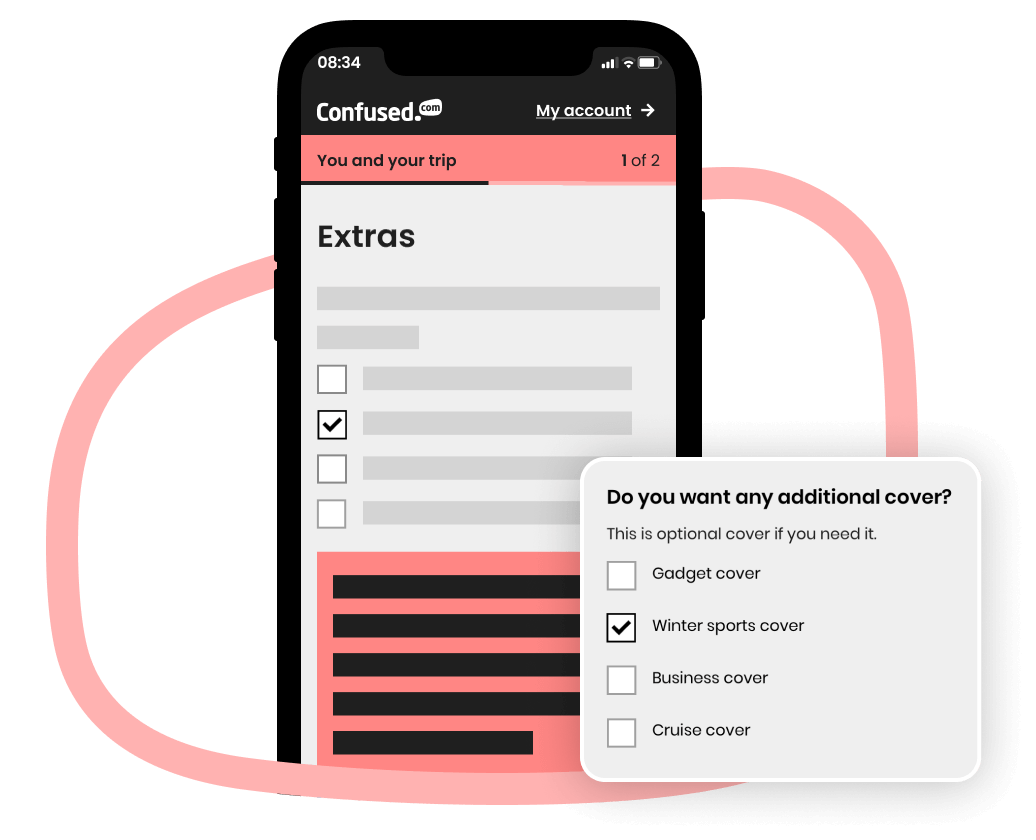

Find winter sports travel insurance by following these steps:

-

Fill out our quote form. We'll need to know where you're travelling, your age and details of any medical conditions you have.

-

Select winter sports cover. When we ask whether you want to include any additional cover on your policy, select winter sports cover.

-

Compare quotes. We'll show you quotes from up to 461 travel insurance providers. Simply compare policy details and choose the one that best suits you!

1Correct as of October 2025

How much does winter sports travel insurance cost?

You could get travel insurance with winter sports cover for £10.173. But, the price you ultimately pay will depend on:

-

Your age. The older you are, the higher your risk of injury. So, travel insurance generally costs more as you age.

-

Your destination. The price of medical treatment in different countries varies, and this can impact insurance prices. For example, travel insurance for the USA is generally more expensive than travel insurance for France because medical treatment can cost much more in the US.

-

The length of your trip. The longer you're away, the higher the risk of something going wrong. So, your insurance will cost more for longer trips.

-

Whether you have any medical conditions. These can increase your chances of needing medical treatment, or cancelling or curtailing your trip. So, you might find that insurance costs more.

3The cheapest price for single-trip travel insurance with winter sports cover added. Based on 1 adult aged 30 with no pre-existing medical conditions, travelling in Italy for 1 week. Confused.com data, October 2025.

What's covered by winter sports insurance?

Travel insurance policies can vary, so it's important to carefully read your policy documents to understand what you're covered for. Winter sports travel insurance add-ons offer additional cover. Let's take a look at what winter sports cover might include or exclude.

What's typically covered:

-

Lost, stolen or damaged equipment. If your winter sports equipment is lost, stolen or damaged.

-

Equipment hire. If your equipment is lost or delayed, your travel insurance should cover the cost of hiring replacement equipment.

-

Lost or stolen ski passes. If you accidentally lose your ski pass or it's been stolen.

-

Mountain rescue. If you need to be airlifted to hospital, or returned back to the UK for treatment.

-

Piste closure. If you experience piste closure for longer than 24 hours.

-

Personal liability. If you accidentally injure someone else, or damage their property.

What's normally excluded:

-

Accidents that occur while under the influence of drugs or alcohol. If illness, injury or death occurs as a result of alcohol or drugs.

-

Not looking after your equipment. If you leave your equipment unattended and it gets stolen, you're unlikely to be covered.

-

Travelling against official government advice. If the government advises not to travel to a certain destination, but you go anyway.

-

Extreme winter sports. Some winter sports might be deemed too high-risk and need a specialist policy. For example, mountaineering.

-

Not using the right equipment. You could invalidate your insurance policy if you don't wear the right gear.

What our travel insurance expert says

Frequently asked questions

Can I get joint or family winter sports travel insurance?

Yes, you can. These policies can be convenient if you’re travelling with your partner or family. They’re often cheaper than buying individual policies for each person. But, it’s always a good idea to compare quotes, especially if someone you’re travelling with has a medical condition. That’s because medical conditions can increase the overall cost of travel insurance.

Are there age restrictions for winter sports insurance?

This will depend on the insurer. Some might set upper age limits. For example, 85 is a common upper age limit to see on winter sports insurance. But it’s always best to read the policy wording as it’ll vary.

Do I need winter sports insurance for a holiday to Lapland?

Depending on the nature of your Lapland getaway, it might be worthwhile having winter sports insurance in place.

Some activities you can do in Lapland might not automatically be covered by travel insurance. For example, sleigh rides are popular, but might be excluded from your travel insurance policy. In this instance, including a winter sports policy add-on could be a good option.

When you’re comparing quotes, read the policy terms and conditions carefully. That way, you’ll know whether you might want to add a winter sports add-on.

Do I need winter sports insurance if I have a GHIC?

The Global Health Insurance Card (GHIC) and the European Health Insurance Card (EHIC) are useful to have. They grant you access to state-level healthcare in participating countries. But they’re not a replacement for travel insurance.

You won’t be able to use your EHIC and GHIC if you need private medical care. This means you’ll have to pay for any medical bills you get from private treatment.

It’s also worth noting that the GHIC and EHIC don’t mean you’ll receive state-level care for free. If you’re in a country where citizens pay for healthcare, you’ll have to pay the same fee that they would.

This is where travel insurance can help. Travel insurance usually includes medical cover, which can cover the cost of medical bills, as well as offer you financial protection in a range of other situations. For example, baggage cover in case you lose your luggage, or travel cancellation cover in case you need to cancel your trip entirely.

Explore other types of travel insurance

Related travel insurance guides

See all travel insurance guidesOur service is free and compares a wide range of trusted household names. Confused.com is an intermediary and receives commission from theidol.com if you decide to buy through our website which is based on a percentage of the total annual premium. We pride ourselves on impartiality and independence – therefore we don't promote any one insurance provider over another.