-

Medical bills: If you need emergency medical treatment because of illness or injury while you're away in Switzerland.

-

Cancellations: Most policies include some kind of cancellation cover that allows you to claim for things like cancelled flights.

-

Emergency repatriation: Policies typically include repatriation cover, which can help with the cost of getting you home if you're too unwell to fly.

-

Theft of or damage to your possessions: Baggage cover allows you to claim if your belongings are stolen or damaged while you're away. It's usually included.

-

Travel disruption cover: Weather, airline strikes and other issues can disrupt your travel plans. Most policies allow you to claim for your accommodation or missed flights as a result of disruption.

What our travel insurance expert says

What will my travel insurance cover while I’m in Switzerland?

Will my travel insurance cover me for skiing in Switzerland?

Standard travel insurance won't normally cover you for skiing, as insurers see it as high risk. Some policies do cover skiing at low levels, though, so it's worth checking the details just in case.

If your policy doesn't include skiing, you'll usually be able to enhance it with a ski insurance add-on.

This could cover your treatment costs for injuries you pick up while skiing, though there are exclusions. Some policies also cover:

- Piste closure

- Damaged equipment

- Mountain rescue

- Personal liability

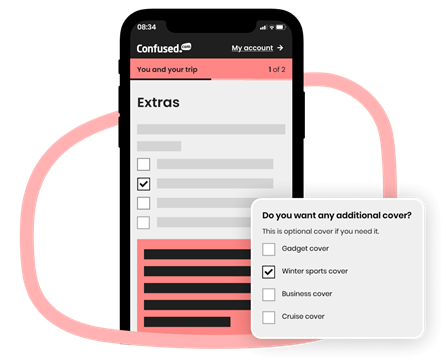

Simply select 'winter sports cover' when asked if you want any additional cover during the quote process.

We'll do the rest to find you a great deal on a policy that'll cover skiing.

Will my travel insurance cover me for other outdoor activities?

This depends on your policy. So, it's important to review the details!

While many people associate Switzerland with skiing, there's much more to explore—from hiking trails like the Alpine Pass and the Via Alpina, to popular rock-climbing spots like Magic Wood,

Most standard policies won't cover these high risk activities though, so you might need to consider adventure travel insurance.

This is an add-on that bumps up your policy to cover you for more adventurous activites.

You'll need to contact your insurer to ask about adding this type of cover to your policy. They'll be more than happy to help you out.

Top tip: When you speak with your insurer, specify all the activities you'll be doing. That way, they can align your policy to your needs.

Adventure travel insurance:

- Can cover riskier activities like rock climbing and hiking

- Costs a little extra to add on to a standard policy

- You'll need to contact your insurer to add it on

How much is travel insurance for Switzerland?

Travel insurance prices for Switzerland:

Solo traveller

£3.901

Couple

£6.102

Family

£10.703

Switzerland travel insurance could set you back as little of £3.90.

Just bear in mind that the prices you're quoted are based on a range of factors, so what you pay might be different. Things like your age, medical history and length of stay can all make a difference.

Get a quote now to see exactly what you could pay. It's quick, easy and free.

1The cheapest price for single-trip travel insurance. Based on 1 adult aged 30 with no pre-existing medical conditions, travelling in Switzerland for 1 week. Confused.com data, January 2025.

2The cheapest price for European annual travel insurance. Based on 1 adult aged 30 with no pre-existing medical conditions. Confused.com data, January 2025.

3The cheapest price for European backpackers travel insurance. Based on 1 adult aged 30 with no pre-existing medical conditions, travelling for 3 months. Confused.com data, January 2025.

What other extras can I add on to my policy?

Travel tips for Switzerland

Be mindful of petty crime

Crime is low in Switzerland. But, there's been increased reports of petty theft in large cities, Geneva airport and trains going to and from Geneva.

It's illegal to cover your face in some places

In Ticino and St Gallen, it's illegal to cover your face in public. This means you aren't allowed to wear balaclavas, full veils or anything else that covers your face. If you don't comply, you might get a fine of anywhere between 100 to 10,000 Swiss francs.

Bring an adapter with you

Switzerland uses type J plugs—the kind that have 3 round pins! So, you'll need to bring an adapter with you to make sure you can charge all of your electronic devices.

English is widely-spoken

The 4 official languages used in Switzerland are German, French, Italian and Romansh. But, English is commonly-used in Switzerland too. So, you won't need to worry about there being any language barriers!

Pack for all types of weather

The weather in Switzerland is generally mild, with warm summers and cold winters. But, it can sometimes be unpredictable. For example, hot weather in the summer can lead to thundery storms. And, during the winter, icy temperatures can drop to below freezing.

So, it's a good idea to bring clothing for all situations—whether the rain is falling, the sun is shining or it's snowing!

Need more help with your trip to Switzerland?

Can I get travel insurance if I have pre-existing conditions?

You can still get travel insurance, even with a pre-existing condition.

In fact, with travel insurance for pre-existing conditions, you can usually get:

- Travel insurance for diabetics

- Travel insurance for high blood pressure

- Travel insurance for heart conditions

Just a heads up, though—you might have to pay a bit more for your insurance, and the number of insurers offering cover could be smaller. That said, it's super important to make sure you declare any conditions when you're getting a quote. If you don't, it could invalidate your policy. That could leave you with some hefty medical bills—especially in Switzerland!

If you're having trouble finding cover through us, don't worry. The Money and Pensions Service (MaPs) has a directory of travel insurance providers that can cover more serious conditions. You can also give them a ring on 0800 138 7777.

Do I need a Visa for Switzerland?

Nope, you're all good!

Switzerland is part of the Schengen Area. So, this means that you can travel there visa-free for up to 90 days as a UK citizen—how great is that? But, if you're planning to stay in Switzerland for longer than 90 days, you'll need to apply for a visa to extend your stay.

Keep in mind, you'll need a European Travel Information and Authorisation System (ETIAS) to travel to countries in the Schengen agreement from 2025. This includes Switzerland. It's not a visa, but an online form that grants you permission to enter the area. But, for the time being, you're free to enjoy your trip without any extra paperwork!

Can I drive in Switzerland on a UK licence?

Yes, you can. And, guess what? You don't need an International Driving Permit, either. Hooray!

But, there's just a few things you'll need to remember to bring along for your trip. Let's check them out:

-

Motorway vignette: To drive in Switzerland, your car will need to have a special vignette to be able to use certain roads. You can grab a physical vignette sticker at border crossing, petrol stations or post offices. Or, you can purchase an e-vignette online. It's up to you which one you prefer!

-

UK sticker: Don't forget to put a UK sticker on your car, along with the vignette.

-

EU driving kit: Last but not least, pack a EU driving kit. This usually includes a warning triangle if you break down and headlamp converters to make sure you don’t dazzle other drivers.

Once you've got these 3 things, you'll be set to hit the Swiss roads! Just make sure you have European car insurance as part of your policy.

Learn more about travel insurance

Our service is free and compares a wide range of trusted household names. Confused.com is an intermediary and receives commission from theidol.com if you decide to buy through our website which is based on a percentage of the total annual premium. We pride ourselves on impartiality and independence – therefore we don't promote any one insurance provider over another.