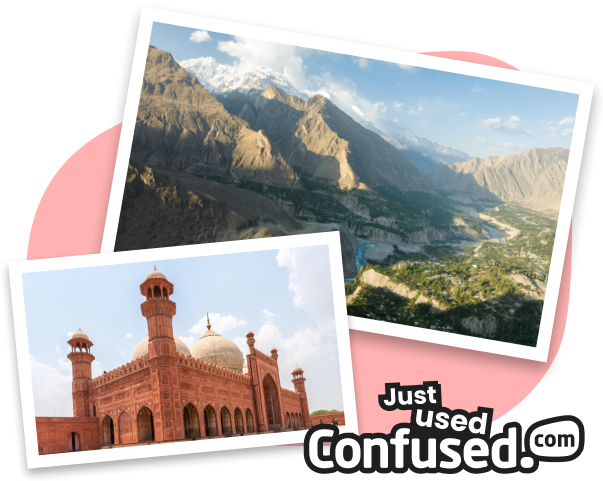

"If you're travelling to Pakistan, having travel insurance in place could prove to be very useful. Travel insurance will cover you for medical emergencies, including evacuation. And since healthcare costs vary outside of the major cities, this could be useful.

"If you're planning on trekking or hiking, you may want cover for activities and sports as well. You'll also be covered against trip cancellations or delays, which is important due to the potential political disruptions you could face. With all this in place, you can fully enjoy Pakistan’s stunning landscapes and culture."