-

Medical bills: If you need medical treatment while you're in France, your insurance policy can cover the cost.

-

Cancellations: You policy will usually include some form of cancellation cover that will allow you to claim for things like cancelled flights.

-

Emergency repatriation: If you become too unwell to travel, your policy's repatriation cover could help with the cost of getting you home.

-

Theft of or damage to your possessions: Your policy should include baggage cover, which allows you to claim if your belongings are stolen or damaged while you're away.

-

Travel disruption: Travel disruption could be the result of adverse weather or strikes. Your travel insurance can cover the cost of your accommodation or missed flights as a result of disruption.

Will my travel insurance cover me for skiing in France?

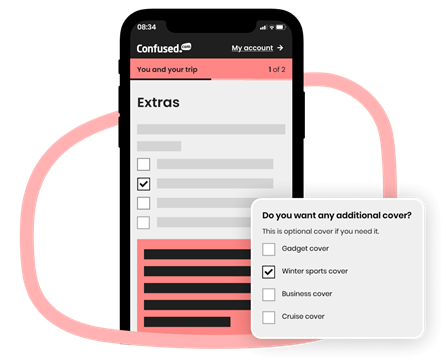

If you're planning a skiing holiday to the alps, you'll need specific ski insurance to cover you.

This is an add-on that you can tack onto your base-level policy. A standard policy won't cover you for any high-risk activities like this.

To make sure you're ready to hit the slopes, select 'winter sports cover' when getting a quote.

Winter sports cover will typically cover you for things like medical bills for injuries sustained while skiing. But it can also cover you for ski-specific things like:

- Loss, theft or damage of ski gear, including ski passes

- Piste closure due to lack of snow or avalanche

- Personal liability costs if you injure someone

- Mountain rescue costs if there's an emergency

What other extras can I add on to my policy?

How much is travel insurance for France?

Travel insurance prices for France.

Solo traveller

£3.181

Couple

£6.122

Family

£12.163

You can get travel insurance for France from as little as £3.18.

But as everything from your age to your medical history and the type of cover you choose can all have an impact. on what you pay, your policy might be priced differently.

To see exactly what it might set you back, compare travel insurance for France with us today. We'll show you our best prices from some of the UK's most trusted insurers.

1The cheapest price for single-trip travel insurance. Based on 1 adult aged 30 with no pre-existing medical conditions, travelling in France for 1 week. Confused.com data, October 2025.

2The cheapest single trip policy for a 30-year-old couple with no previous medical conditions, travelling to France for 1 week. Confused.com data, October 2025.

3The cheapest single trip family policy for a 30 year-old couple and 2 children under 5, travelling to France for 1 week. Confused.com data, October 2025.

What do I need to drive in France?

To drive in France there a few requirements:

- You must be 18 or over.

- You’ll need a full UK driving licence.

You’ll need car insurance too.

If you already have UK car insurance, your policy may cover you for driving in Europe. But it's always worth checking. You should also be aware that it may only give you 3rd party protection while you're driving abroad, even if you have a fully comprehensive policy.

If you want to up this to fully comprehensive European car insurance, you can normally enhance your cover by contacting your insurance provider.

You’ll also need:

A UK sticker

The UK sticker replaced the GB sticker in 2021. If you fail to display a UK sticker on your vehicle, you may be stopped and fined.

A Crit’Air sticker

In France, Crit'Air stickers are used to categorise different vehicles based on the level of emissions they produce. The cost of the sticker is €3.72, including postage in France. It's €4.61 including international postage if you buy in the UK. You can buy them from the French government website. The current fines for not having one are €68 for a private car and €135 for a coach.1

A breakdown safety pack

This should include reflective jackets for all passengers and a warning triangle. You get a fine of up to €135 for each item you don't bring, so make sure you're fully prepared!

Snow chains

Though you'll only need these if you're driving in the snow. France has many beautiful mountain roads, so if you're driving through the Col d'Iseran or Petit St Bernard, make sure you bring snow chains with you.

1Prices correct as of October 2024.

What our travel insurance expert says

Discover other destinations

- Travel insurance for Austria

- Belgium Travel Insurance

- Bulgaria travel insurance

- Travel insurance for Tenerife and the Canary islands

- Travel insurance for Croatia

- Travel insurance for Cyprus

- Czech Republic Travel Insurance

- Germany travel insurance

- Travel insurance for Greece

- Iceland travel insurance

- Ireland travel insurance

- Travel insurance for Italy

- Majorca Travel Insurance

- Malta Travel Insurance

- Netherlands Travel Insurance

- Travel insurance for Poland

- Travel insurance for Portugal

- Schengen Area travel insurance

- Travel insurance for Spain

- Travel insurance for Switzerland

Need more help with your trip to France?

What else do I need to know before I travel to France?

Visas

You don’t need a visa if you’re spending less than 90 days in the Schengen area, which includes France. You can spend 90 to 180 days here without a visa, but after this you’ll need one. You’ll also need a visa to work in France. The GOV.UK website provides guidelines for people travelling to France for work.

Other entry requirements

You’ll need a passport with an expiry date at least 3 months after you plan to leave the Schengen area.

A passport with a date of issue less than 10 years before the date you arrive.

If you’re staying with friends or family, your host may need an ‘attestation d’accueil’ which they can acquire from their local mayor’s office.

Learn more about travelling to Europe with our handy guide.

Crime

While crime isn’t particularly high in France, it’s worth noting that thieves and pickpockets do operate in some areas. They're particularly prevalent on the Paris Metro, on RER train lines (particularly RER line B) and at mainline stations.

Face covering ban

Face coverings are banned in France, and carry a heavy penalty of up to 150 euros. This includes balaclavas, veils or any other garment or mask that hides your face. Forcing someone to hide their face is also a crime and is punishable by a year’s imprisonment and a fine of up to 30,000 euros. If the person forced to hide their face is under 18 years old, the sentence is doubled. This law applies to all tourists.

Will my travel insurance cover me for a business trip to france?

If you're going to be working in France, you should consider getting business travel insurance.

You should check if you have cover with your company, and if not, you'll need to take out this cover yourself. Select business travel insurance when you're getting a quote and we'll help you find our best deal.

Learn more about travel insurance

Our service is free and compares a wide range of trusted household names. Confused.com is an intermediary and receives commission from theidol.com if you decide to buy through our website which is based on a percentage of the total annual premium. We pride ourselves on impartiality and independence – therefore we don't promote any one insurance provider over another.