From shopping, commuting to work, or popping home to see family, taking a car to university can make life easier.

But which university students pay the most to run a car near campus?

Between textbooks, living costs and keeping money back for socialising, managing your budget at university isn’t always easy.

And any additional costs, such as parking, petrol and car insurance, can quickly use up your student loan.

But how does your choice of university impact the cost of running a car?

Motoring insurance experts at Confused.com calculated the annual cost of running a car at UK universities. We used this research to find the most and least affordable universities for young motorists.

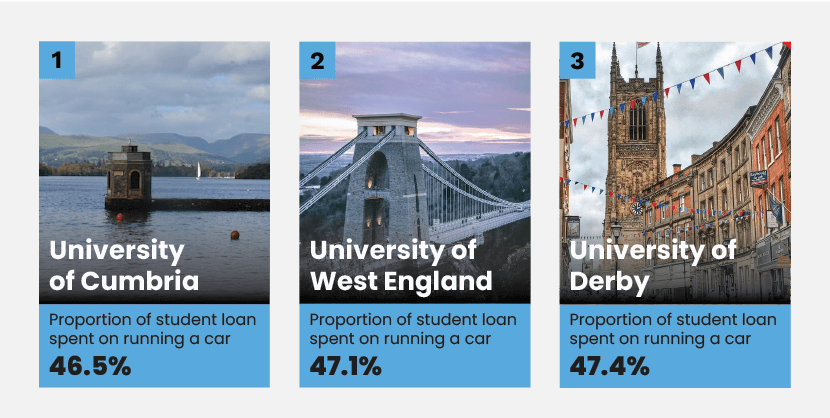

Most affordable universities for drivers

Students living near the University of Cumbria spend around £2,165 a year to run a car. They also pay the least for their student car insurance (£982) and just £64 on parking costs.

With costs taking up 47.4% of a student loan, the University of Derby is the second most affordable university to keep a car at.

Rounding out the top three, Aberystwyth University ranked third among the most affordable universities for drivers, with driving at the Welsh university accounting for 48.1% of student loan amounts.

Top 10 least expensive universities for drivers

| University | Annual Student Loan* | Annual Petrol Cost | Annual Parking Cost | Annual Insurance Cost | Total Annual | % of loan |

|---|---|---|---|---|---|---|

|

University of Cumbria

|

£4,651

|

£1,119

|

£64

|

£982

|

£2,165

|

46.50%

|

|

Aberystwyth University

|

£4,651

|

£1,120

|

£42

|

£1,073

|

£2,235

|

48.10%

|

|

Trinity St David

|

£4,651

|

£1,112

|

£0

|

£1,140

|

£2,252

|

48.40%

|

|

University of Bath

|

£4,651

|

£1,080

|

£153

|

£1,127

|

£2,361

|

50.80%

|

|

Heriot-Watt University

|

£4,651

|

£1,127

|

£0

|

£1,302

|

£2,429

|

52.20%

|

|

Bangor University

|

£4,651

|

£1,087

|

£40

|

£1,324

|

£2,450

|

52.70%

|

|

University of Worcester

|

£4,651

|

£1,128

|

£174

|

£1,196

|

£2,499

|

53.70%

|

|

Royal Holloway

|

£4,651

|

£1,119

|

£0

|

£1,400

|

"£2,518

|

54.10%

|

|

Glyndwr University

|

£4,651

|

£1,059

|

£0

|

£1,491

|

£2,551

|

54.80%

|

*maximum available, non-income assessed maintenance loan

Least affordable universities for drivers

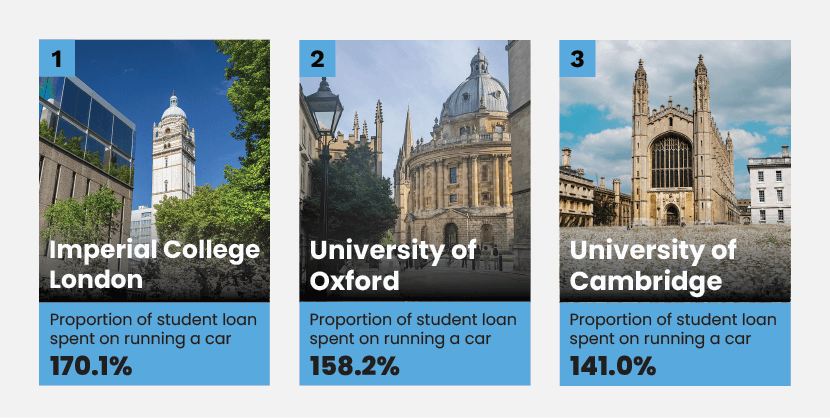

According to our research, running a car at some of the country’s most prestigious schools could cost up to 170% of your student loan.

Between parking, petrol and insurance, students at Imperial College London could spend over £11,029 a year to run a car. Parking was the most significant expense at £7,200, accounting for 65% of the total cost.

Oxford is the second most unaffordable for drivers. Students who take their car with them to Oxford also have to fork out the most for petrol at £1,246 a year.

The third most unaffordable university is Cambridge, where the cost of running a car takes 141% of a student loan. Despite being slightly less expensive than its old rival, students at Cambridge pay the second-highest parking costs.

Other institutions that would require spending more than 100% of your student loan to run a car include:

- Glasgow Caledonian University

- University of Strathclyde

- Newcastle University

- University of Leicester

- University of Leeds

- Leeds Beckett University

- University of Manchester

- Manchester Metropolitan University

- Birmingham City University

- University for the Creative Arts

Top 10 most expensive universities for drivers

| University | Annual student Loan* | Annual Petrol Cost | Annual Parking Cost | Annual Insurance Cost | Total Annual Cost | % Of Loan |

|---|---|---|---|---|---|---|

|

Imperial College London

|

£6,485

|

£1,102

|

£7,200

|

£2,727

|

£11,029

|

170.10%

|

|

University of Oxford

|

£4,651

|

£1,246

|

£3,768

|

£2,346

|

£7,360

|

158.20%

|

|

University of Cambridge

|

£4,651

|

£1,120

|

£4,014

|

£1,424

|

£6,558

|

141.00%

|

|

Glasgow Caledonian University

|

£4,651

|

£1,096

|

£2,700

|

£2,122

|

£5,918

|

127.20%

|

|

University of Strathclyde

|

£4,651

|

£1,096

|

£2,151

|

£2,122

|

£5,369

|

115.40%

|

|

Newcastle University

|

£4,651

|

£1,112

|

£900

|

£2,998

|

£5,010

|

107.70%

|

|

University of Leicester

|

£4,651

|

£1,096

|

£1,080

|

£2,759

|

£4,935

|

106.10%

|

|

University of Leeds

|

£4,651

|

£1,000

|

£1,440

|

£2,445

|

£4,885

|

105.00%

|

|

Leeds Beckett University

|

£4,651

|

£1,000

|

£1,440

|

£2,445

|

£4,885

|

105.00%

|

|

University of Manchester

|

£4,651

|

£1,046

|

£646

|

£3,089

|

£4,781

|

102.8%

|

*maximum available, non-income assessed maintenance loan.

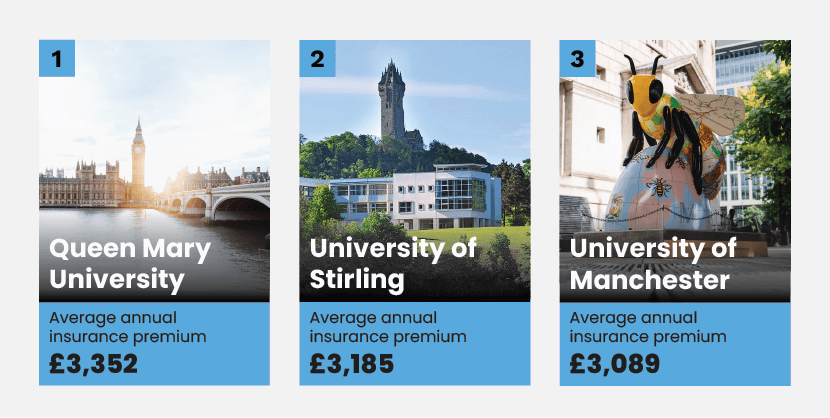

Most expensive universities for car insurance

The make and model of your car is one of the main factors used to calculate the cost of your car insurance. But where you live can also affect your premium.

Students at Queen Mary University in London pay the most to insure their car at university. It costs £3,352 on average. ”For a lot of young people, going to university is the first time that they’re expected to be fully in control of their finances. So while taking your car with you can be convenient, it’s worth working out your budget to make sure you can afford it. “If you do decide to take your car to university, remember to change your address with your insurance provider. A typical university year is about 30 weeks, and the registered address for your car should be where it’s parked most of the time. “You might have to pay a small fee, but you run the risk of having an insurance claim denied if your details are incorrect.”

Located in East London, the high population density and busy roads are probably the reason for high insurance premiums. Generally, cities are also likely to have higher rates of crime. This can increase your premiums too.

The University of Stirling is situated within a walled estate, but students can still expect to pay £3,185 a year to insure their vehicle.

While the city centre locations present obvious dangers for drivers, more rural settings have their own hazards that can affect your car insurance.

Rural roads usually aren’t well-lit. They can be more prone to ice or standing water. Sharp and blind corners can be common on country lanes too. These factors mean motorists are more at risk of having a car accident.

Students at the University of Manchester pay the third most for their car insurance at an average cost of £3,089 a year. The busy roads of Manchester city centre present plenty of hazards for drivers. This might explain the high cost of insurance premiums in the area.

It’s also worth noting that typical student areas can also be more attractive to thieves, due to factors like the transient nature of the neighbourhoods, and general lack of secure parking.

What our motor insurance expert says: