Driverless cars, also called autonomous vehicles, can operate without human intervention. They rely on a computer system, motion sensors, and communication technologies. These help them understand their environment and travel to a given destination all by themselves.

In 2023, the UK’s then-transport secretary, Mark Harper, said that driverless cars could be on the road by 2026. Other forecasts suggest that fully autonomous vehicles are still decades away.

Regardless of the timeline, it seems inevitable that autonomous cars will become widespread sooner or later. But what would this mean for car insurers?

In this article, I look at the benefits of driverless cars and the challenges and obstacles that insurers face.

What do we mean by driverless cars?

Many vehicles already have some level of automation. From cruise control to Tesla’s Autopilot system, all these systems still need human intervention. True self-driving vehicles refer to cars that can operate entirely independently.

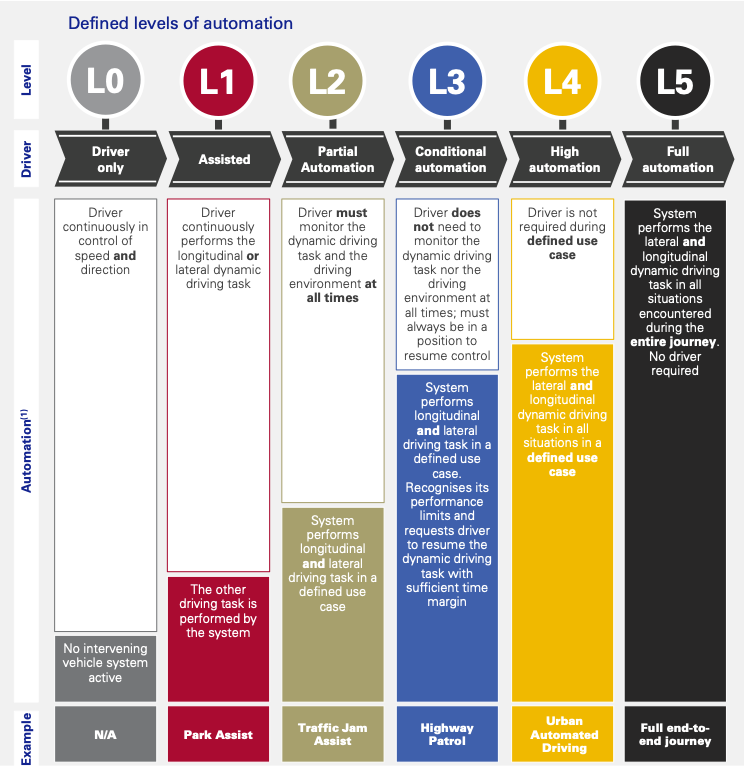

To understand how automated a vehicle is, the ‘Levels of Driving Automation’ scale by the Society of Automotive Engineers (SAE) can be helpful.

The SAE scale has six levels, from 0 to 5:

- L0: Driver-only. These are conventional vehicles in which the human driver is entirely in control. There are no Advanced Driver-Assistance Systems (ADAS).

- L1: Assisted. In L1 vehicles, the driver controls driving forwards, backwards, and side to side. But, the computer offers some driver assistance. For instance, lane-keep assist can take over partial vehicle control and adjust the steering wheel to keep the driver in the centre of the lane. Emergency braking is a common feature to help drivers avoid collisions.

- L2: Partial automation. The driver must still check their driving and the surroundings at all times. But, automation can perform some tasks in defined use cases, such as traffic jam assistance.

- L3: Conditional automation. Level 3 vehicles can perform longitudinal and lateral driving tasks. The driver wouldn’t need to monitor at all times in certain situations, but must always be in a position to take control.

- L4: High automation. The driver wouldn’t be required during a defined use case, at a particular speed or context, such as urban driving.

- L5: Full automation. L5 promises automation across the entire journey. The driver’s seat can be empty.

When we talk about true self-driving cars, we mean L5. Car companies are already selling cars with driver assistance systems, putting them at L2 or L3.

Image source: KMPG

What would be the benefits of fully driverless cars?

Driverless cars have long been part of our cultural narrative. One of the earliest mentions dates all the way back to 1930, in the Miles Breuer novel Paradise and Iron. But why have we been so fascinated by this concept and its promise? In my view, if driverless cars become mainstream, the benefits could be substantial.

1. Autonomous vehicles could bring safety benefits by eliminating human error

According to the US National Highway Traffic Safety Administration (NHTSA), 94% of traffic accidents are due to “human error”.

This statistic has become controversial in recent years. Political critics and commentators have suggested that it's blaming individuals for more systemic problems, like larger cars or poor road design, which makes driving more difficult.

But the research is clear. Many accidents happen because drivers are distracted, tired, or make a mistake. There can be more sinister causes, too. Despite strong penalties for drinking and driving, the UK government reported that drivers over the alcohol limit caused 17% of road casualties in 2021.

But are self-driving cars better drivers than humans? It seems so.

Evidence from a study by insurer Swiss Re and Waymo, formerly the Google Self-Driving Car Project, supports this claim. It found that in over 3.8 million miles driven from San Francisco to Phoenix, there were zero car accident injuries. Property damage claims fell by 76%.

Not all research agrees that driverless cars are safer. This high-profile study from the University of Michigan Transportation Research Institute found that autonomous vehicles may actually be more dangerous. But, the research is nearly a decade old. Since then, autonomous technology has greatly improved.

Based on the most recent data, autonomous vehicles will almost certainly reduce the risk of accidents by eliminating the driver entirely.

The perception of safety is also a massive factor in the potential adoption of driverless cars. If consumers don’t feel autonomous cars are safe, they won’t use them. This perception is fuelled by stories of vehicles stopping dead on the road or high-profile lawsuits.

These situations are rare. But, they have a lasting impact on how people see driverless cars.

2. Driverless cars could lower costs for drivers in the long run

Alongside offering potential safety improvements, driverless cars promise lower running costs, too.

One way that they reduce costs is through improved driving efficiency. For instance, models have predicted that if just 5% of vehicles were autonomous, traffic flow would improve. Similarly, researchers at MIT found that artificial intelligence (AI) in autonomous vehicles can help reduce idling and vehicle emissions at traffic lights. Machine learning technology can analyse driving trends and algorithms to make the vehicle as efficient as possible.

If driverless cars were to become mainstream, they could save consumers a considerable amount in vehicle charging costs. This is due to more efficient automated driving.

According to the MIT study, if all vehicles were autonomous, they could “reduce fuel consumption by 18% and carbon dioxide emissions by 25%.” The researchers also found that travel speeds would increase by 20% due to reduced stopping times.

Another area where consumers could potentially save is in insurance. Imagine a world with only driverless vehicles. Safety improvements could cut the number of insurance claims. This could lower premiums for drivers.

As Swiss Re and Waymo found in their study, autonomous vehicles could reduce property damage claims by 76%. Lower claims risks typically mean lower costs for consumers, simply because costs for insurers are lower, too.

But if cars no longer have drivers, what's being insured, and who's at fault in an accident? These are some challenges that insurers will need to consider carefully.

What challenges would driverless cars pose for motor insurers?

By removing the driver entirely, autonomous vehicles would fundamentally shift how insurers price policies and manage claims. It would be a truly transformative moment in the history of motor insurance.

1. Driverless cars would change the data needed to price premiums

Currently, motor insurers calculate risk and set premiums based on info about the vehicle and the driver.

They'll consider details like the age and power of a vehicle. They'll also consider the likelihood of it being involved in claims. They might even use vehicle telematics, which collects live data on the car’s activity. They'll cross-reference it with data on the driver's age, gender, driving history, and claims.

If there's no driver, most of the data that insurers use will no longer be relevant. In an autonomous vehicle, who's sitting behind the wheel will have no impact on claim risk.

Instead, the risk of accidents will depend entirely on the car's mechanics and technology. This will include computer software that understands the vehicle’s surroundings, chooses a route, and controls its motion.

Instead of insuring a driver, insurers will assess the likelihood of the vehicle working as intended. This approach would represent a profound shift for the motor insurance industry.

An additional challenge here is that insurers won’t immediately have the real-world data available to understand the likelihood of autonomous vehicles having an accident. Insuring vehicles without this data poses a real risk to insurers. And so, in the short term, they’ll understandably need to price high to cover that risk.

2. Driverless cars would make it more difficult to assign fault during an accident

If one driverless car collides with another, who is to blame?

To answer this question in the context of conventional cars, insurers would typically assess which driver made a mistake while driving. With autonomous vehicles, this assessment may be more complex.

Insurers currently hold the driver liable for accidents. This is the case in instances of limited automation, such as the Tesla autopilot. These features provide limited automation. But, they explicitly require the driver's attention who ought to intervene to prevent an accident.

However, in the case of a fully driverless vehicle, would it make sense to hold drivers liable? Instead of a human error, the accident would be entirely down to a software error or vehicle malfunction.

As a result, even if claims may be less common, they’re likely to be more complex. Claims processes wouldn't just involve an analysis of the incident. They would also include a technical analysis of the computers that guide the vehicle.

It seems likely that the onus would be on the vehicle manufacturer rather than the “driver.” Assigning responsibility could ultimately lead to the manufacturer rather than the vehicle owner (assuming the owner has their car serviced as per manufacturer guidance). As a result, driverless cars would fundamentally change motor insurance as we know it.

3. A mix of driverless and conventional vehicles would likely pose additional difficulties

A world with only autonomous vehicles may be easier for insurers than the transitional stage. With only driverless cars on the road, we'll likely see an entirely different insurance landscape. Yet, at least there would be consistency in managing claims and premiums.

But, sharing the road with autonomous and conventional vehicles would pose unique challenges. Are collisions more or less likely? Who would be responsible if autonomous and conventional vehicles collide? What processes would be necessary to resolve claims fairly?

For insurers, this transitional period could be more challenging than a fully driverless world.

What are the obstacles to driverless cars becoming mainstream?

Once driverless cars hit the market, insurers will have much to consider.

But in my view, we’re not likely to see the mainstream adoption of driverless vehicles any time soon. Some substantial obstacles stand in the way.

1. Consumers aren’t yet convinced of the benefits of driverless cars

Studies show that many consumers are interested in driverless cars. But, many still need convincing. For instance, a global study by Capgemini found that 59% of consumers are awaiting driverless cars “with anticipation”. 41% are not interested.

65% of survey respondents to a Ghost Autonomy study would want autonomous driving in their car in the next decade if the technology were proven to be safe. Recent studies show that driverless cars are safe, but it’s difficult for the consumer to have confidence until we see them on the roads.

A recent US study by Forbes found that only 29% of consumers would be willing to pay a premium for self-driving technology. Plus, 93% of Americans have concerns about some aspects of driverless cars. They're particularly worried about safety and technology malfunctions.

Overall, if autonomous vehicles are to go mainstream, it’s clear that consumers need convincing. They may need to see robust evidence that these cars are safe. Early adopters taking the plunge and using driverless cars on the road will play a big part in building consumer confidence.

2. The immediate cost of autonomous vehicles may be prohibitive to most people

Forbes’s driverless car study suggests that less than a third of people are willing to pay more for an autonomous vehicle. However, these vehicles will almost certainly cost more, at least in the immediate term.

We only need to look at electric vehicle (EV) costs to see how new technology comes at an often unaffordable premium. 2023 data from JATO shows that in Europe, the average price of a new EV is 27% more than its internal combustion engine (ICE) equivalent. According to the research, no new EVs were available in Europe or the US for under €20,000 (US$21,300).

EVs and autonomous vehicles promise to be cheaper to run after those upfront costs. This is due to greater efficiency and the comparative cost of electricity to conventional fuels. According to a 2021 study by Avicenne Energy for the Nickel Institute, in the UK, EVs could cost up to €25,000 less to run over 10 years than conventional vehicles. These savings could increase further with the additional technology offered by autonomous vehicles.

However, insurance costs are likely to be higher, as EVs’ technology is more complex. According to research by Thatcham Research, EV incident claims are 25.5% more expensive than those for ICE equivalents.

This difference is likely even greater with autonomous vehicles, at least in the short term. Insurers don’t have the data they need to cover autonomous vehicles accurately. So, they'll understandably price higher to cover their risk.

As a result, driverless cars (just like EVs) are unlikely to be accessible to everyone—even if they’re cheaper in the long run.

3. Autonomous vehicles becoming mainstream depends on widespread EV adoption happening first

If we haven’t transitioned to electric vehicles, we’re unlikely to adopt autonomous vehicles any time soon.

The UK has a goal of being all-electric by 2030, but it’s currently not certain that we'll get there. In a recent study by Leasing Options, the UK placed 23rd among 30 European countries for EV incentives. The lack of government help to buy these vehicles may affect the feasibility of that 2030 goal.

Ultimately, we’re pushing towards EVs because of their environmental and health benefits. The same goes for autonomous vehicles, which combine these environmental benefits with potentially significant reductions in the risk of accidents. This could be a good enough reason for the government to use regulation to increase the attractiveness of these vehicles.

In fact, for the adoption of autonomous vehicles to take off, governments may have to act.

4. Autonomous cars are a potentially risky proposition for manufacturers

Some of the biggest car manufacturers in the world are busy creating the technology for autonomous vehicles. While they offer significant opportunities for innovation, driverless cars aren't risk-free for manufacturers.

Forbes’s US study into perceptions of driverless cars found that 62% of consumers have lost confidence in Tesla. This is due to recent safety issues and technology recalls. In February 2024, over 2 million vehicles were recalled due to warning lights being too small. Additionally, this particular manufacturer is currently facing at least a dozen lawsuits for malfunctions in its AutoPilot features.

Tesla has become a symbol of driverless technology. However, their vehicles’ apparent unreliability could create a negative perception for the autonomous vehicle industry as a whole.

That said, Tesla is taking risks that the automotive industry will need to take to develop fully autonomous vehicles. Other manufacturers will get to learn from their mistakes and improve on the technology.

How will the transition to driverless cars get started?

Driverless cars are unlikely to be mainstream in the near future. The technology is still in development, consumers are unconvinced, and insurers need to work out how to cover these vehicles.

However, when it does happen, here are my predictions for what that process might look like.

1. Early adopters will provide invaluable data for insurers

The first people to drive autonomous vehicles will likely be tech enthusiasts. They’ll be people excited by new technology in cars and willing to take the risk. It’s also likely that cost won’t be a significant obstacle for them.

These early adopters will be crucial for insurance companies. They must gather real-world data on the benefits and risks of driverless cars. This data will need to come from real users, not just the manufacturers. Insurers need to see how they operate alongside conventional vehicles on the road. While insurers collect this data, early adopters will likely pay significantly more for their cover than a conventional car.

Most drivers will want to see costs come down substantially before they take the plunge. Yet, these costs will only come down if early adopters bite the bullet.

2. In the face of high costs, autonomous vehicles may become a car-as-a-service offering

The cost of autonomous vehicles is likely to be high. Insuring them is complex. So, average drivers may be unable to own one. Instead of owning them, perhaps we’re more likely to simply use these vehicles.

For instance, autonomous cars may be used as “driverless-taxis”, which can arrive at your door unmanned to take you to your destination. In this case, a vehicle would be a service, rather than a personal product that sits outside your home for whenever you need it.

If used like this, the personal barriers to adoption may be less significant. Instead of relying on an individual’s purchase, these vehicles would act something like a fully-automated Uber. Their users wouldn’t need to be insured at all.

Of course, there are issues around this model. Firstly, would users be happy to ride in a driverless Uber? How would today’s cab drivers respond to such a model? And who would own these vehicles?

Plus, would people be willing to give up driving? Older drivers who have owned a car all their lives may be less attracted by such a prospect than younger customers such as Gen Alpha.

Insurers would need to consider their own business model in this scenario. As individuals wouldn’t need insurance, the direct-to-consumer market is unlikely to continue. So, where could insurers turn to make a profit?

3. Autonomous vehicles may only become mainstream with government regulation

With so many obstacles, autonomous vehicles may only become mainstream with a push by the government. If studies continue to show the health, safety, and environmental benefits of driverless cars, there would be grounds for governments to actively support their adoption.

This could be in the form of a purchase incentive, like the early tax benefits of owning an EV vs a traditional car. But if autonomous vehicles are primarily used in car clubs and as robo-taxis, we may see a different form of support.

The UK government recently published a toolkit for local authorities about car clubs. This provides advice on how councils can support car clubs locally, particularly those using EVs. If driverless technology becomes readily available, we could see a similar government push on autonomous car clubs.

Moreover, the government can encourage insurers to adapt to the new conditions that autonomous vehicles might offer. Recent legislation, such as the general insurance pricing practices (GIPP), has shown that insurers can make big changes when needed.

Mainstream autonomous vehicles will fundamentally change motor insurance – but not any time soon

In this article, I’ve shared my thoughts about the opportunities and challenges that driverless cars might offer. While the safety and efficiency benefits of driverless cars are promising, insurers will have many complexities to solve.

While the insurance industry needs to consider driverless cars’ impact, it's still a long way off.

Firstly, we’ll need to see electric vehicles becoming completely mainstream. For this to happen, we need to see charging infrastructure improved and costs come down.

To stay in the loop about how the industry can adapt to the latest technology, learn more about what we do at Confused.com.