"Automatics can be pricier to insure than manual cars of a similar specification. But things like your no claims bonus, age and licence type can often help offset this. Not to mention comparing quotes. So don’t let the potential for a higher premium put you off. There are always ways to save. "

Are automatic cars more expensive to insure than manual ones?

| Driver Age | Average automatic insurance cost* | Average manual insurance cost* |

|---|---|---|

|

All ages

|

£1,039

|

£867

|

|

17-25

|

£2,724

|

£2,150

|

|

50+

|

£707

|

£547

|

*Confused.com data Q2 2024. Comprehensive policies only.

Yes, car insurance is generally more expensive for automatic cars than for manuals. There are a few reasons for this:

Automatics are less common

As fewer people drive automatics, they tend to be more expensive to buy - and therefore replace. This makes them more expensive to insure.

Automatic gearboxes are more complex

This makes them more expensive to fix or replace than a manual gearbox if anything goes wrong.

They may attract riskier drivers

Some insurers might view automatic drivers as less competent than manual drivers, as automatics tend to be seen as an easier option for those who've struggled to pass their test in a manual car.

Automatics tend to be in higher car insurance groups

The higher the insurance group a car’s in, the pricier it'll be to insure. Use our car insurance group checker to find your car's group.

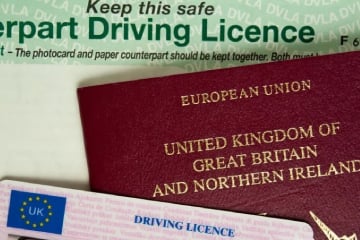

Is it cheaper to insure an automatic with a full UK licence?

Average automatic car insurance costs by licence type**:

Full UK licence

£953

Automatic-only licence

£1,780

**Confused.com data Q2 2024. Comprehensive policies only.

Yes, it’s usually cheaper to insure an automatic car if you have a manual licence.

When it comes to calculating the price of cover, insurers take numerous factors into consideration. On one hand, an automatic car is generally more expensive to fix than a manual one. But the type of licence you hold is also a rating factor for insurers - meaning they'll take it into consideration when working out your price.

Car insurance providers' statistics tend to show that customers are more likely to claim on their insurance if they have an automatic-only licence. This means their insurance will usually be priced higher.

If you're weighing up whether to learn in a manual or an automatic, this isn’t the only factor to take into consideration… But it’s definitely a tick in the manual licence box.

Either way, compare car insurance quotes to find the best price for your situation, whether you drive a manual or automatic.

How can I save on automatic car insurance?

Choose fully comprehensive cover

Despite offering a greater level of protection, comprehensive car insurance is usually cheaper on average than third party.

Pay annually instead of monthly

If you can cover the cost of an annual policy upfront, it’s always better to do so than paying monthly. This is because monthly payments have interest added on. If you pay for the year upfront, you could save 38%*.

Get a multi car policy

Insuring several cars on one multi car policy will help to drive down the overall cost, regardless of the cars’ transmission.

Buy a car in a low insurance group

While automatic cars tend to be in higher car insurance groups than their manual equivalents, there are still automatics in lower groups. And the lower the car insurance group, the cheaper your insurance could be.

Add a named driver

Adding an experienced driver to your policy can help to bring the cost down. Alternatively, you could be added as a named driver yourself. In either case, it’s important that the main driver on the policy is the one who drives the car the most. Not being honest about this is a type of fraud called ‘fronting’, which is illegal and could invalidate your insurance.

*Confused.com data Q2 2024.

What insurance group are automatic cars in?

Automatic cars are typically in higher insurance groups than manual cars. This is because they’re usually more expensive, and can be trickier to fix.

All cars in the UK are grouped into 1 of 50 groups. The lower your car's group, the cheaper your insurance tend to be.

But groups are just one factor insurers look at when calculating your car insurance costs. So don't assume your premium will be low just because you have a car in a low insurance group.

Check what group your car is in with our group checker tool.

Car insurance group checker

The car

Insurance group

Group

9/50

Our customers say:

Are all electric cars automatic?

| Vehicle type (automatic) | Average cost* |

|---|---|

|

Electric car

|

£860

|

|

Hybrid

|

£1,052

|

|

Petrol/diesel

|

£1,049

|

*Confused.com data Q2 2024. Comprehensive cover only.

Well, they are and they aren’t.

The ‘automatic’ refers to the automatic shifting of gears. But electric vehicles (EVs) only have one gear, so they don’t need to shift between them - either manually or automatically.

But when it comes to the driving experience, the vast majority of EVs are like automatics. This is because you don’t need to worry about changing gear, and you don’t have a clutch. There are two pedals to accelerate and brake, and there will be three basic modes - drive, reverse and park - controlled by a lever, button or switch (or ‘gearstick’).

There may also be additional modes - such as eco, or a sports mode in performance cars. But by and large, driving an EV is much like driving an automatic. And it’s arguably worth getting used to, as petrol and diesel cars are being phased out, meaning this kind of driving style is almost inevitable.

It is possible to get EVs with a manual gearbox, intended to preserve the driving experience. However, these can be very expensive.

Looking to insure an electric car? We can help there too.

What our car insurance expert says

Need more help with automatic car insurance?

Can I drive an automatic on a manual licence?

Yes. Passing your driving test using a manual vehicle means your licence allows you to drive both a manual and an automatic.

It doesn't work the other way around though. If you have an automatic-only licence, you won’t be able to drive manual cars. In fact, getting caught driving with the wrong kind of licence is a motoring offence. This could land you a fine of up to £1,000, and 3-6 penalty points on your licence.

Need more help?

See all car insurance guidesExplore other types of car insurance

Page last reviewed: 15 July 2024

Reviewed by: Louise Thomas