"Finding off-road cover can be tricky - but it does exist. The easiest way to find it is by getting a quote, then contacting the insurer directly to see if they’ll allow you to add it onto your policy. If not, try a 4x4 owner’s group. These can be a great resource, and other members will often be able to point you in the right direction."

What insurance do I need for my 4x4?

This can depend on the size and design of your 4x4, as well as how you use it.

Car insurance

Pick-up insurance

Temporary insurance

Classic car insurance

Is it more expensive to insure a 4x4?

Car insurance costs £735* on average, but a lot of factors go into how your car insurance is calculated.

This means that in some cases, you might pay less than the average for insurance for a 4x4. But in others, you might find you pay more.

This can be influenced by:

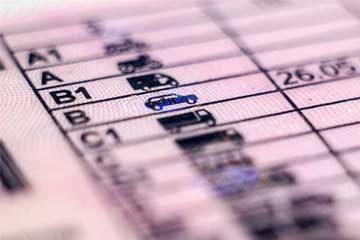

Your 4x4’s classification

Pickup-style 4x4s need van insurance, but car-like 4x4s need car insurance. The type of cover you need affects what you pay.

Your 4x4’s insurance group

Every car sits in one of 50 car insurance groups. Due to their size and the cost to repair them, 4x4s tend to sit in high groups. The higher the group, the more you're likely to pay for your insurance.

Your 4x4’s size

As 4x4s tend to be large, heavy vehicles, the damage they can do in collisions is likewise large. Insurers tend to see them as ‘riskier’ to insure than normal cars as a result, meaning you can sometimes pay more to insure them.

Your 4x4's country of origin

Imported car insurance tends to be a bit more expensive than standard car insurance as the parts for them can be more difficult to source. Insurers often seem them as 'riskier' than non-imported cars too, which makes them more expensive to insure.

Find out exactly how much it'll cost for insurance for your 4x4 in just a few minutes by comparing quotes with us.

*UK car insurance prices report June - August 2025.

What our car insurance expert says

What else could my insurance cover?

Although off-roading may not be covered, insurance for a 4x4 should provide you with cover for other common aspects of 4x4 driving: